Throughout the operation of your establishment, there will be times when you want to update company information, tip and tax information, or create discounts for your customers to use.

You can do all these operations using the Curv POS system.

Follow these steps to keep your operations streamlined.

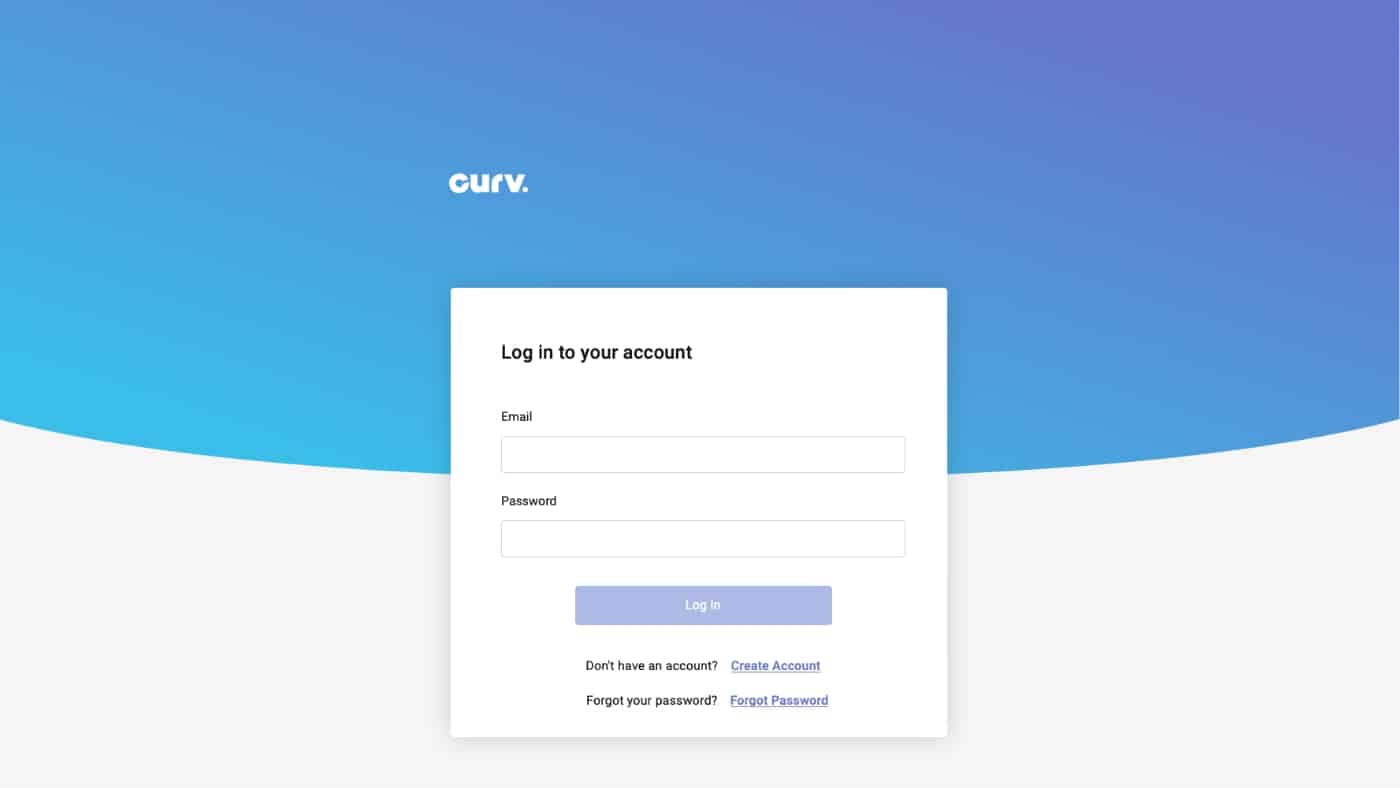

1. Log into the Curv web portal using the “Email” and “Password” you setup during sign-up.

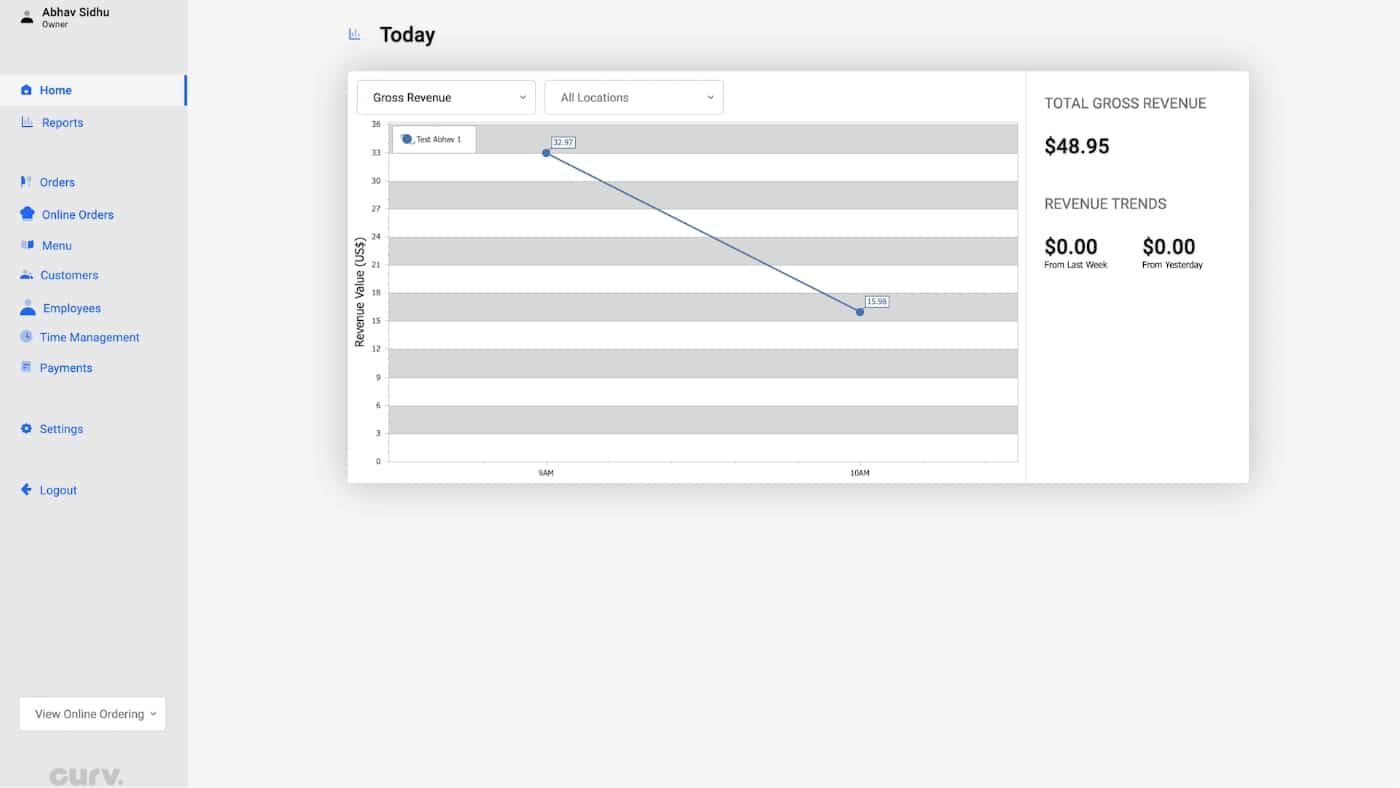

2. Once you are logged in, you see the summary of your restaurant’s transactional history.

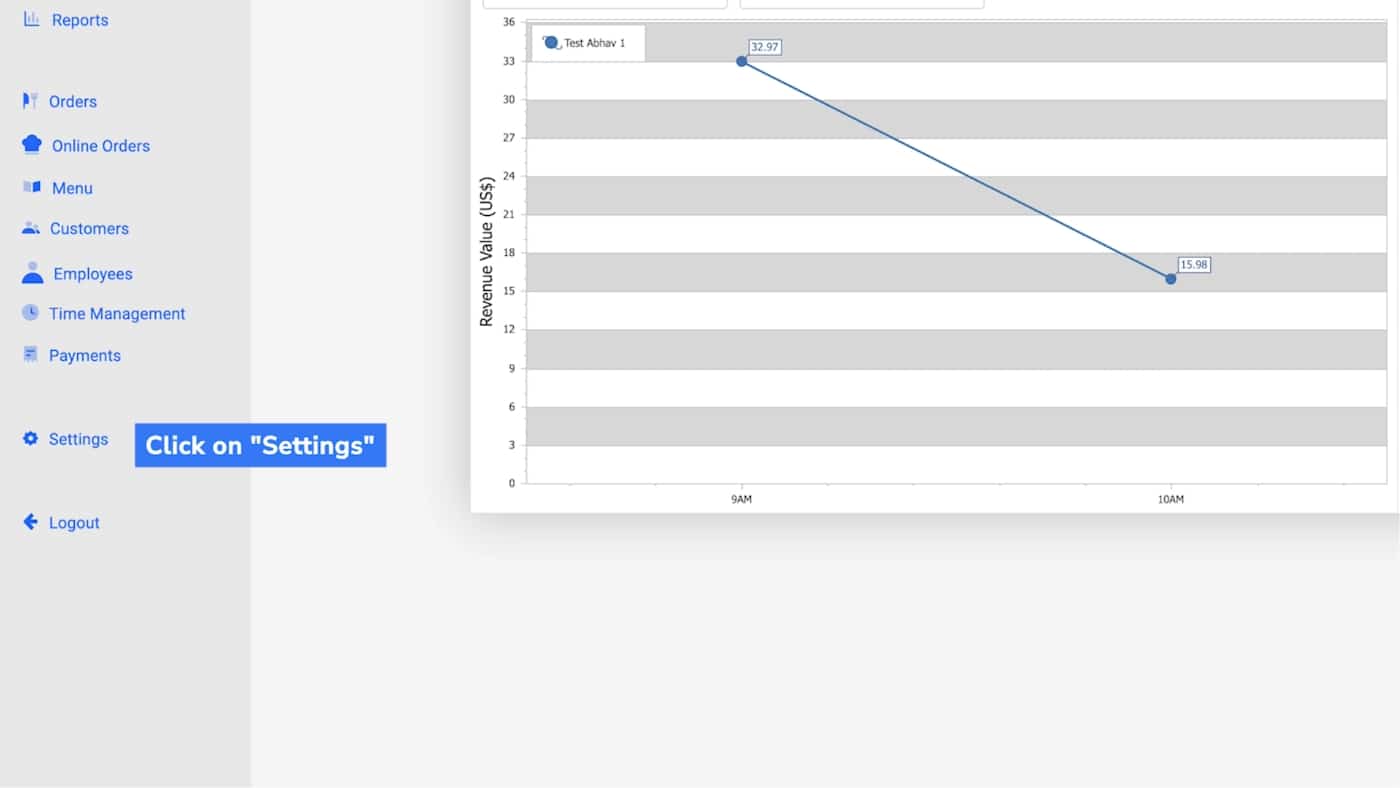

3. Click “Settings” to see all the information about your restaurant.

Company Tab

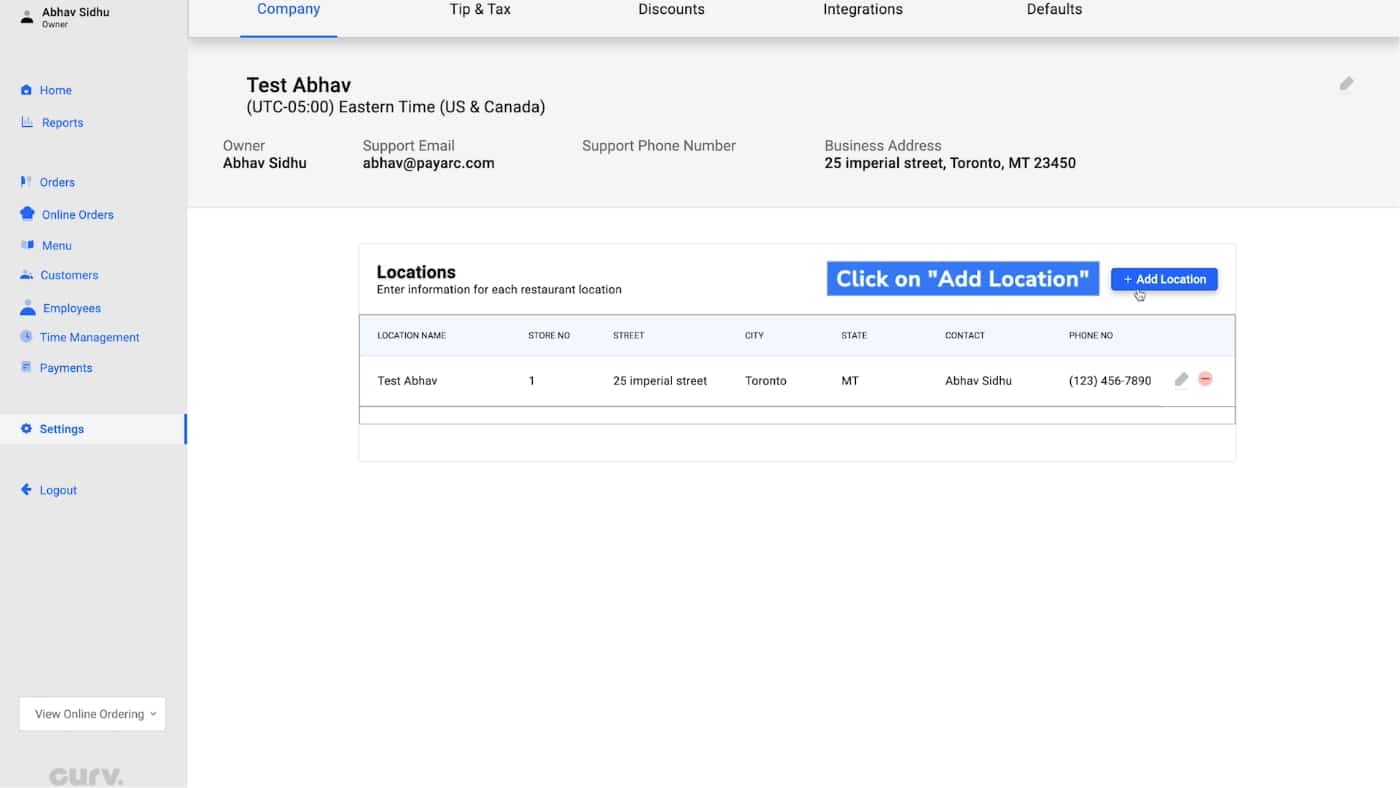

1. The first tab relates to information about your establishment. To add in your restaurant location, click “Add Location.”

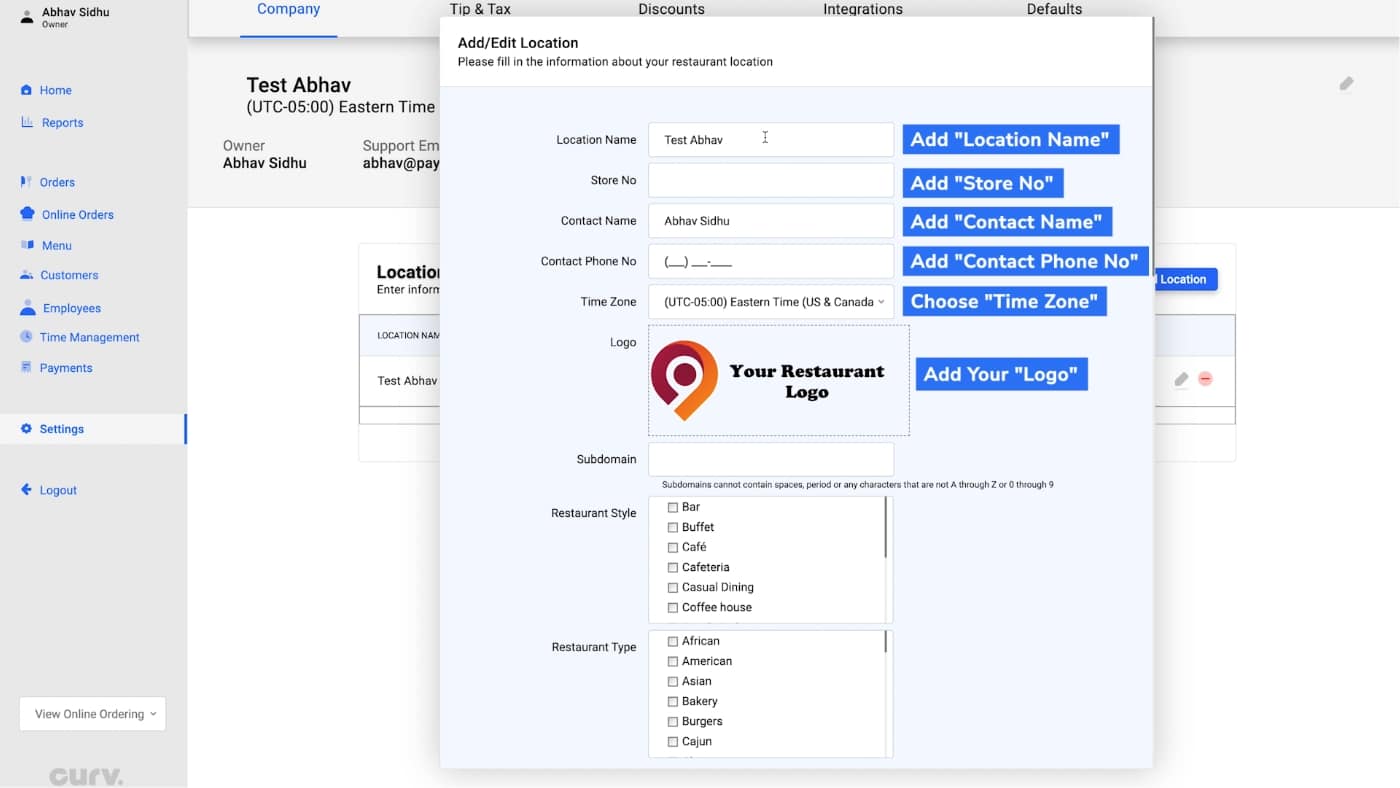

2. Enter details about your location. Once complete, click “Save.”

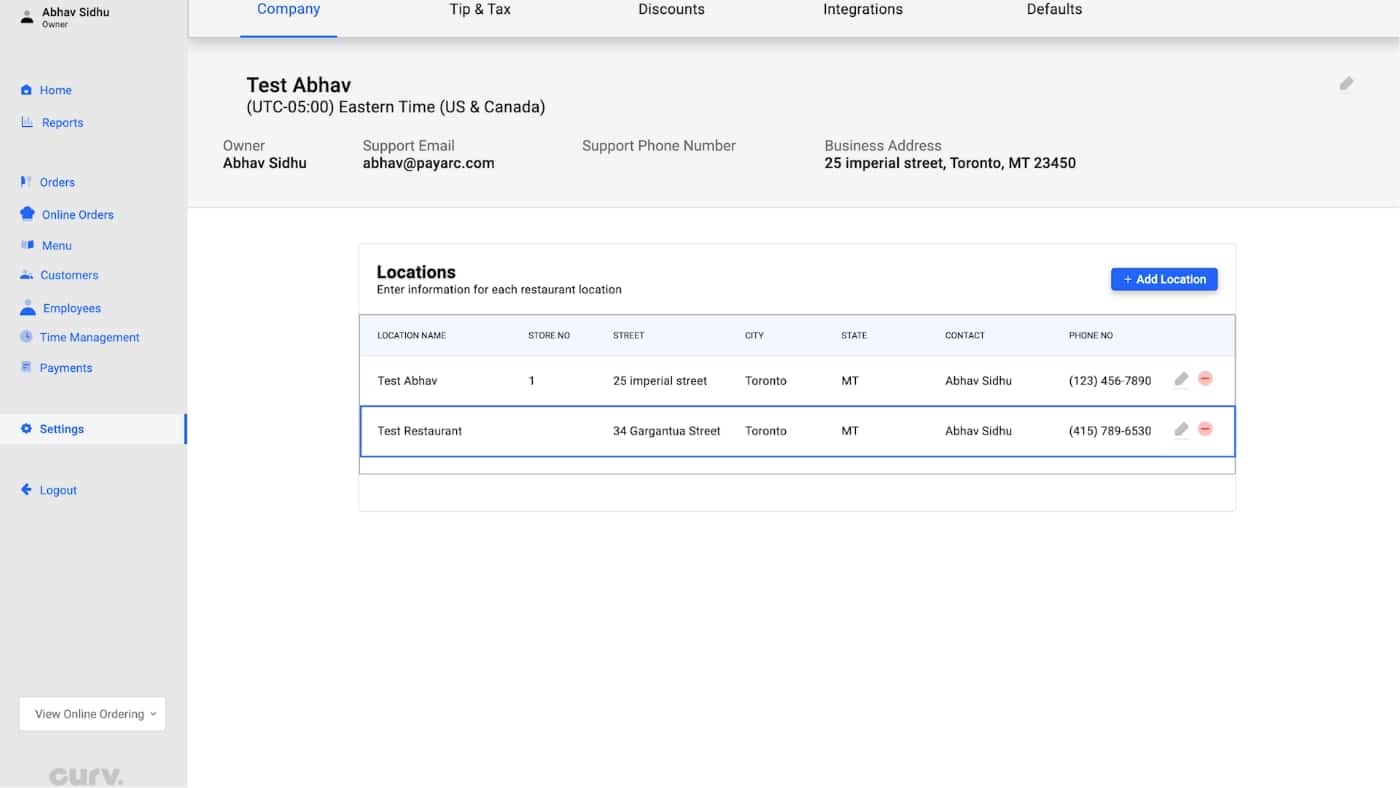

3. The new location will be added to the system. You will be able to see it as part of the restaurant under the “Settings” tab.

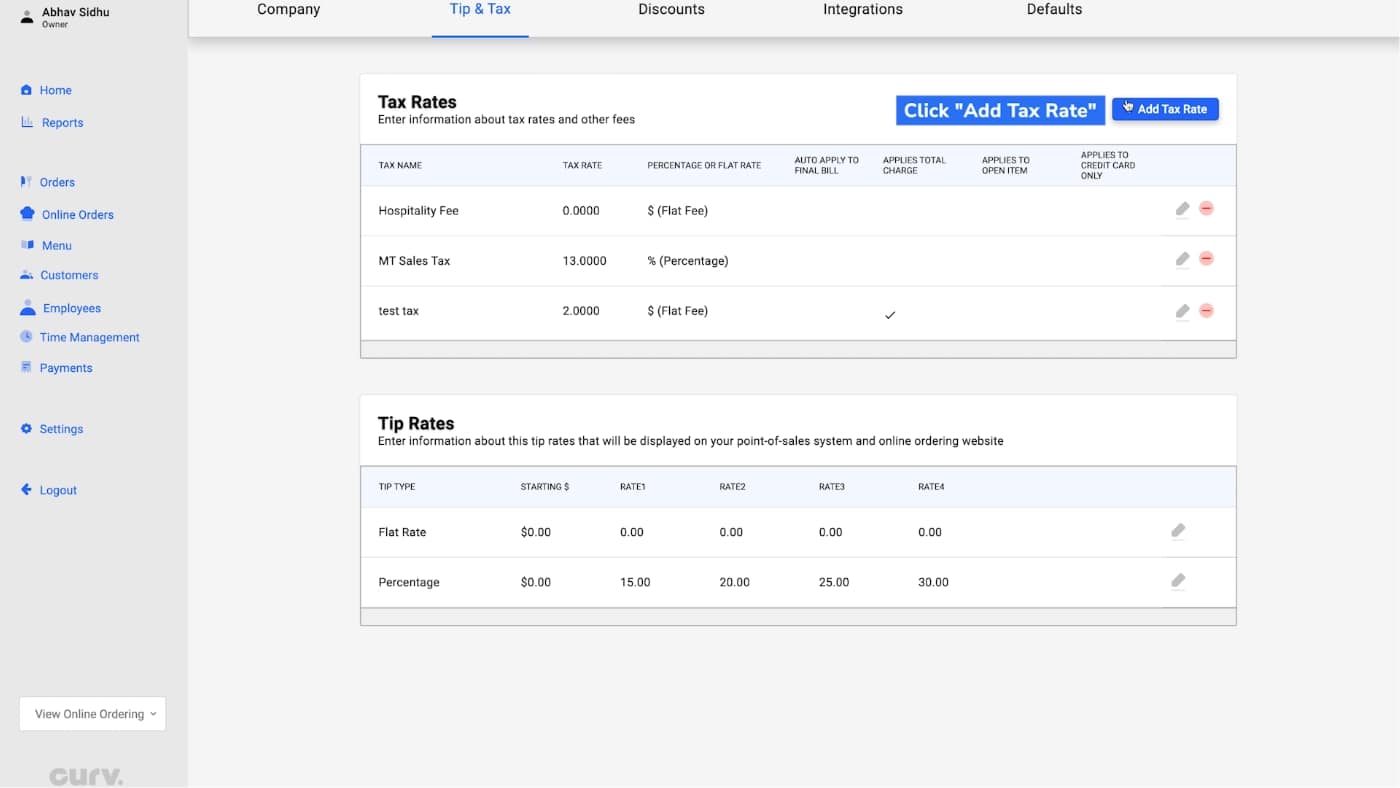

Tip & Tax

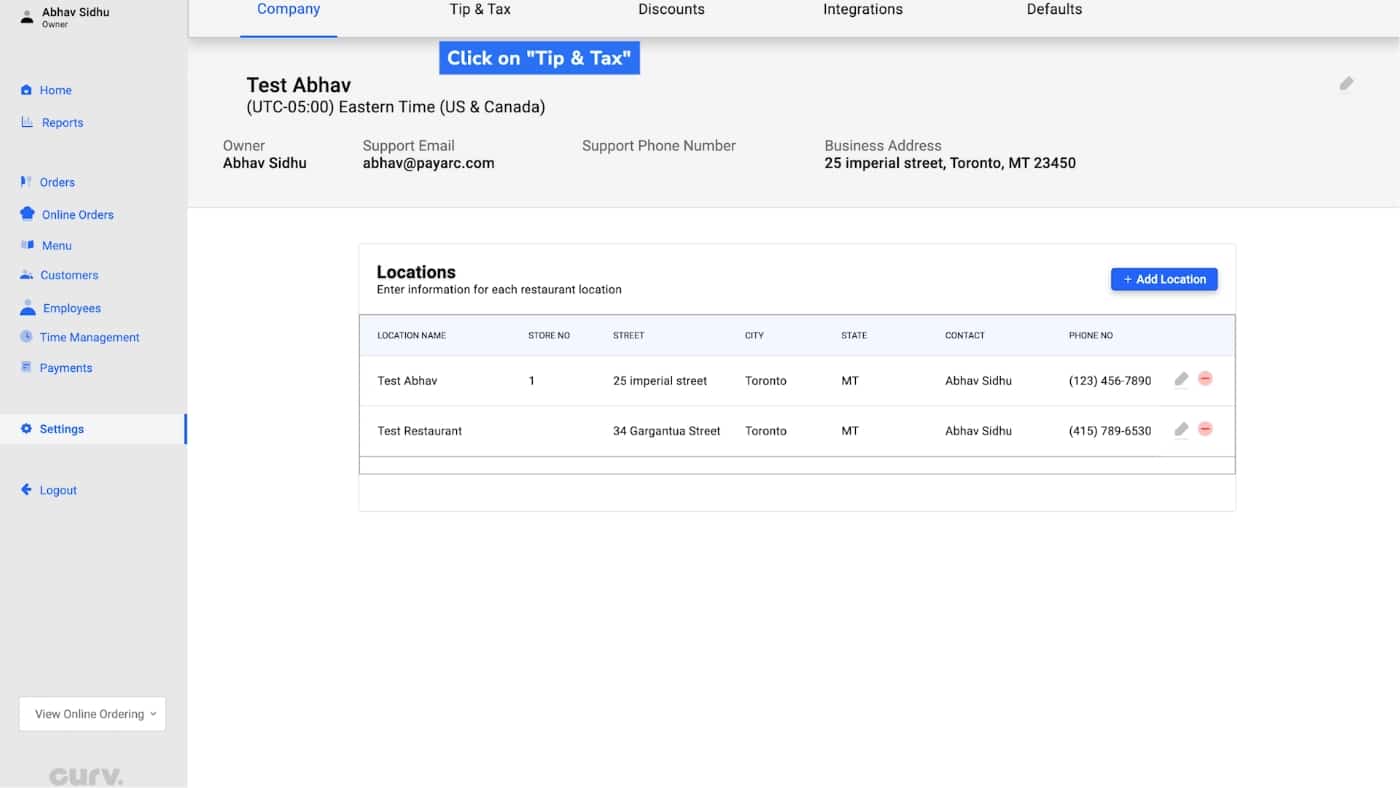

1. To add in information about tips and taxes, click “Tip & Tax.”

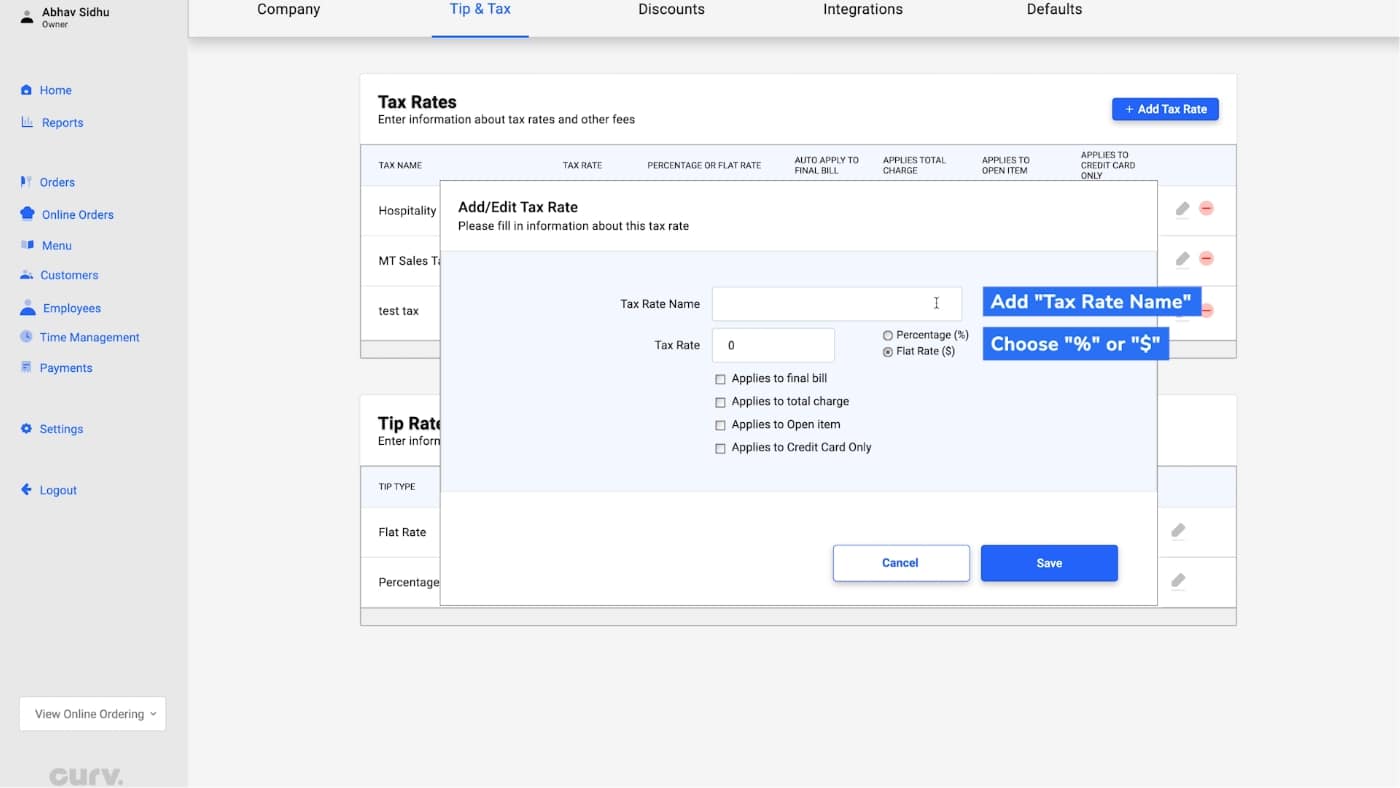

2. To add a new tax rate, click “Add Tax Rate.”

3. Enter in “Tax Rate Name” and “Tax Rate” which can be expressed as a “%” (percentage) or “$” (standard rate). Once complete, click “Save.”

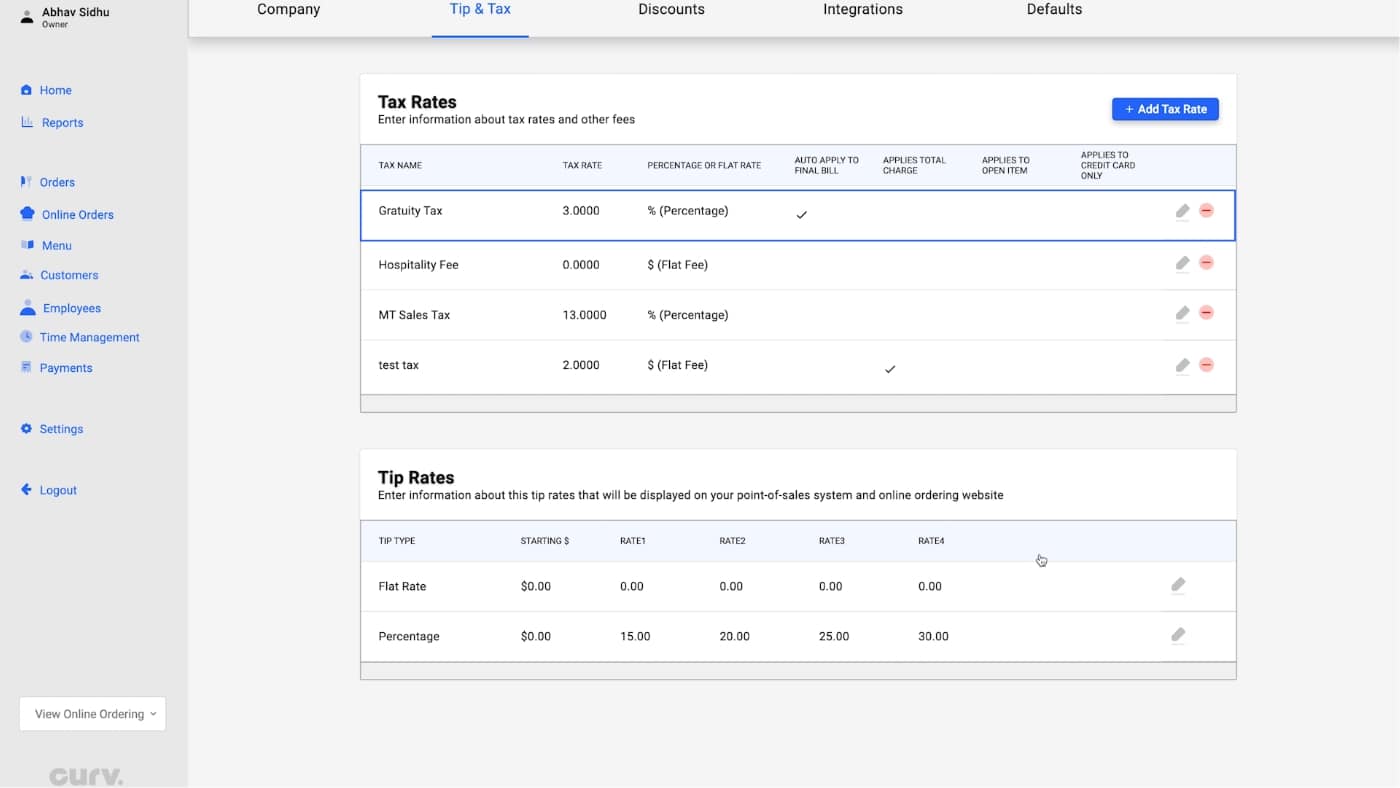

4. You can view the new “Tax Rate Name” under “Tax Rates.”

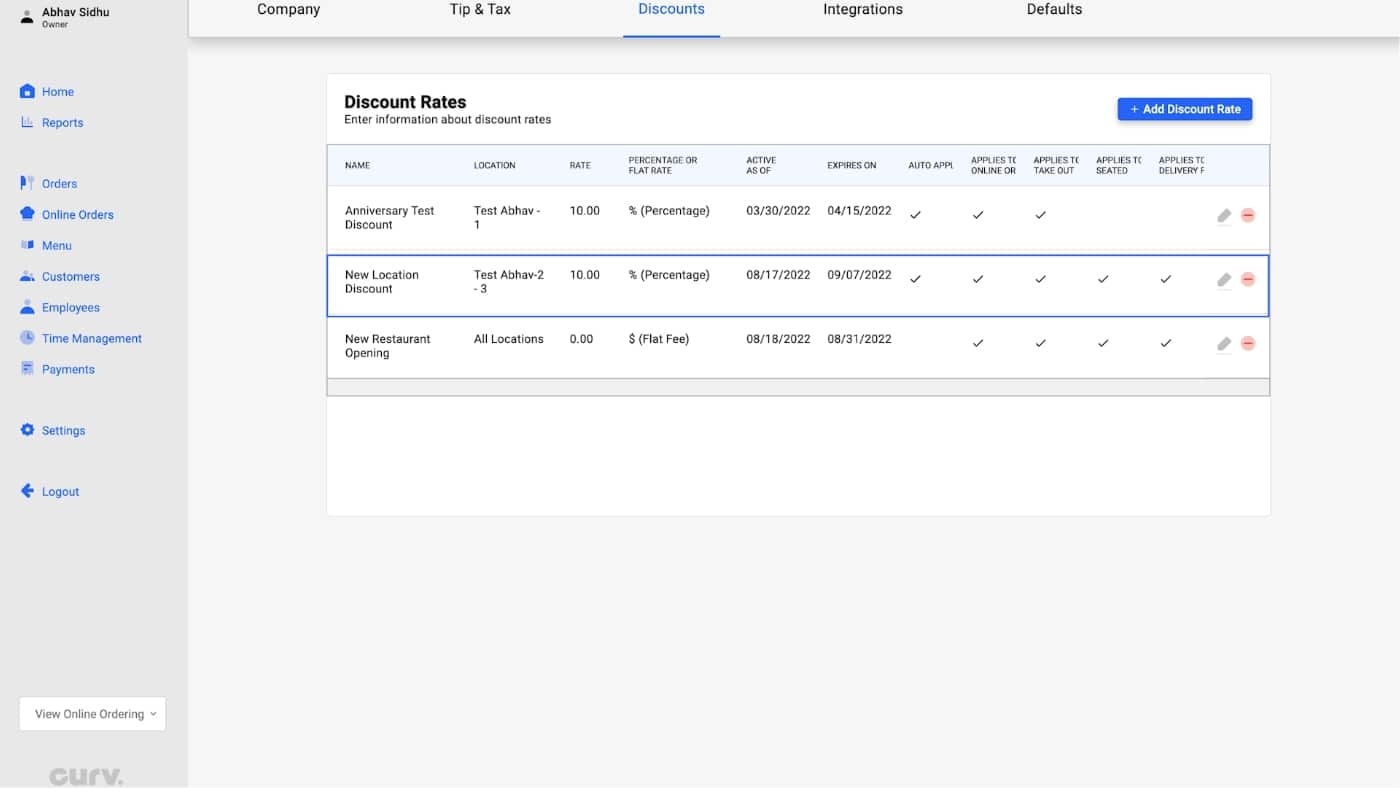

Discounts

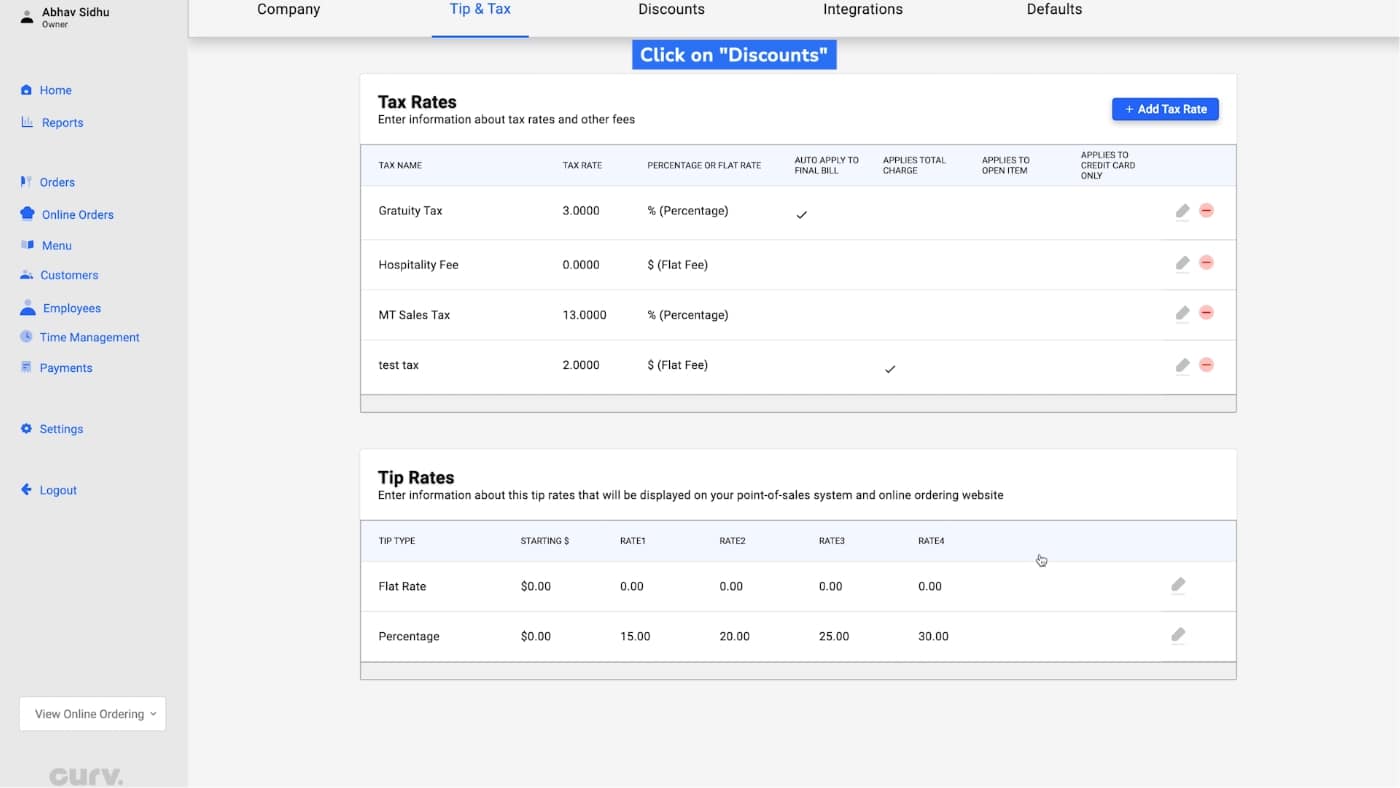

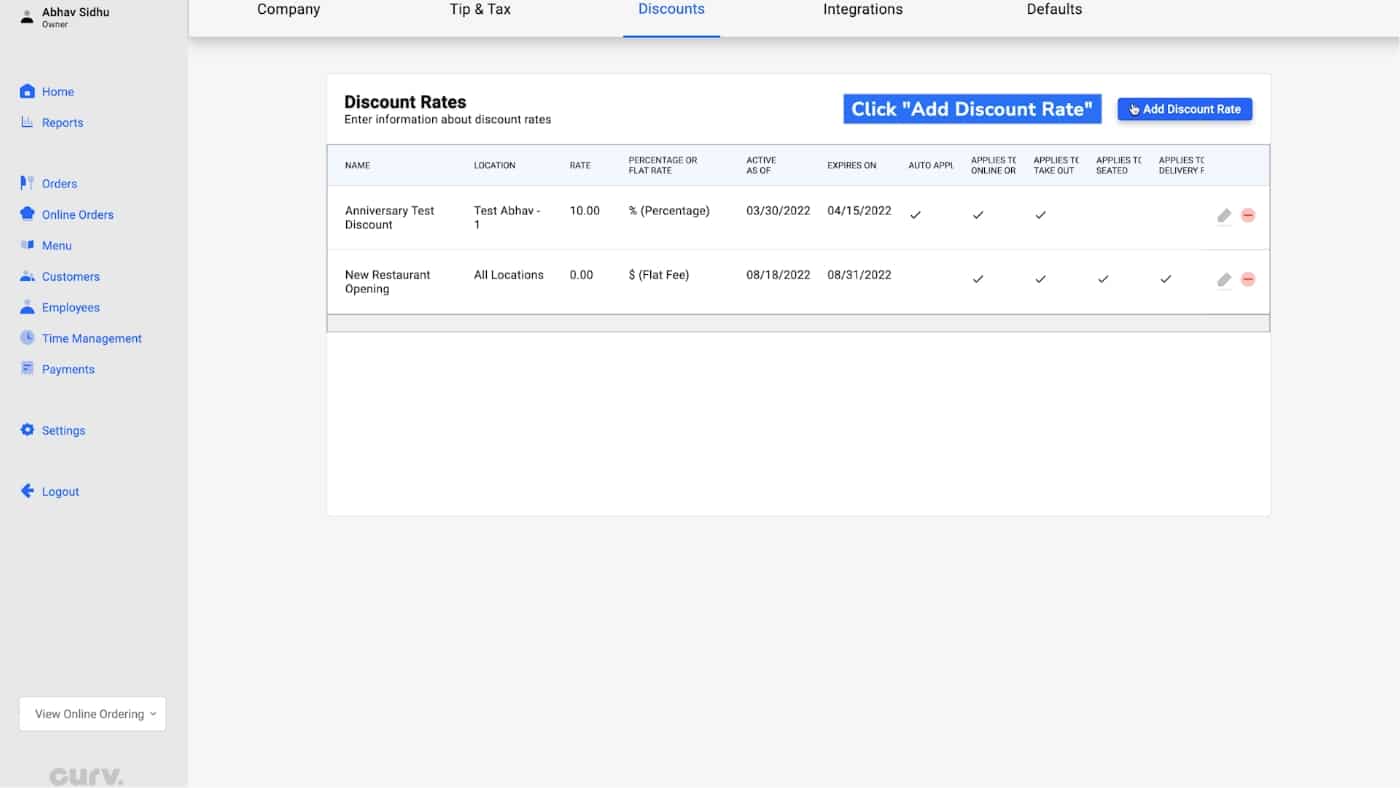

1. To issue a discount for your customers, click “Discounts.”

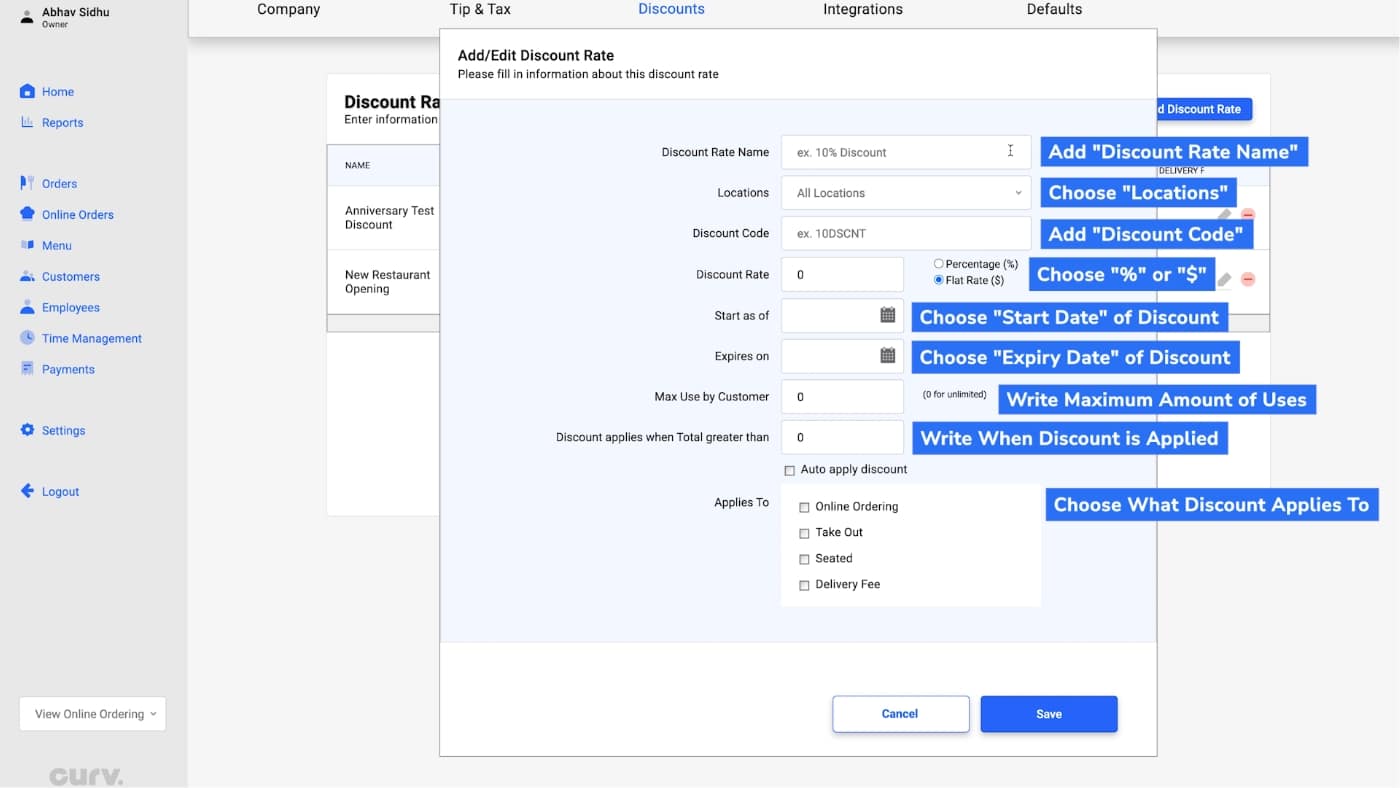

2. To add a new discount rate, click “Add Discount Rate.”

3. Enter discount information. Once complete, click “Save.”

4. The new discount will be added into the system and can be viewed under the “Discount Rates” category.